Mortgage capacity calculator

Think of it as a maximum borrowing power calculator helping you work out what a bank takes into consideration to ensure you could repay your home loan and meet your other outgoings. Whether the business intends to take up residence on the property immediately build on the land or simply hold it for a designated period the banks point of view is still the same.

Mortgage Payment Rate Calculators True North Mortgage

The 28 part of the rule is that you shouldnt spend more than 28 of your pre-tax monthly income on home-related expenses.

. Full-function mortgage calculator LVR borrowing capacity Property upsizedownsize Principal payback milestone Break fee calculator Fix or float calculator Credit card real cost Real cost of debt Retirement. We considered all applicable closing costs including the mortgage tax transfer tax and both fixed and variable fees. Learn your limits - suss out your borrowing capacity so you can start planning that purchase.

Use our VIC stamp duty calculator to find out how much stamp duty is paid when buying property. Understanding mortgage payment deferral. Your home must be worth at least 70000 or 100000 depending on your property type and product chosen.

If not the calculator will. A mortgage calculator helps to. For example a circuit.

Our borrowing power calculator asks you to enter details including your loan term and interest rate income and expenses and any outstanding. It also allows you to adjust the loan amount and tenor to arrive at an EMI value that suits your repayment capacity enabling you to plan the repayment in advance and thereby minimize the chances of defaulting. Use of this site constitutes acceptance.

A lifetime mortgage is a loan secured on your home. A mortgage calculator can be a handy tool to help navigate finances prior to kickstarting your home-buying journey. Youll need to be living in or buying your own home with either a small or no mortgage.

If the property is located in a city or town that has mortgage tax youll pay an additional 25 to 50 cents. A Loan Against Property EMI calculator is an online tool that computes monthly instalments interest payable and the total cost of loan. Capacity-The overall capacity at which you can repay back the loan is also very important.

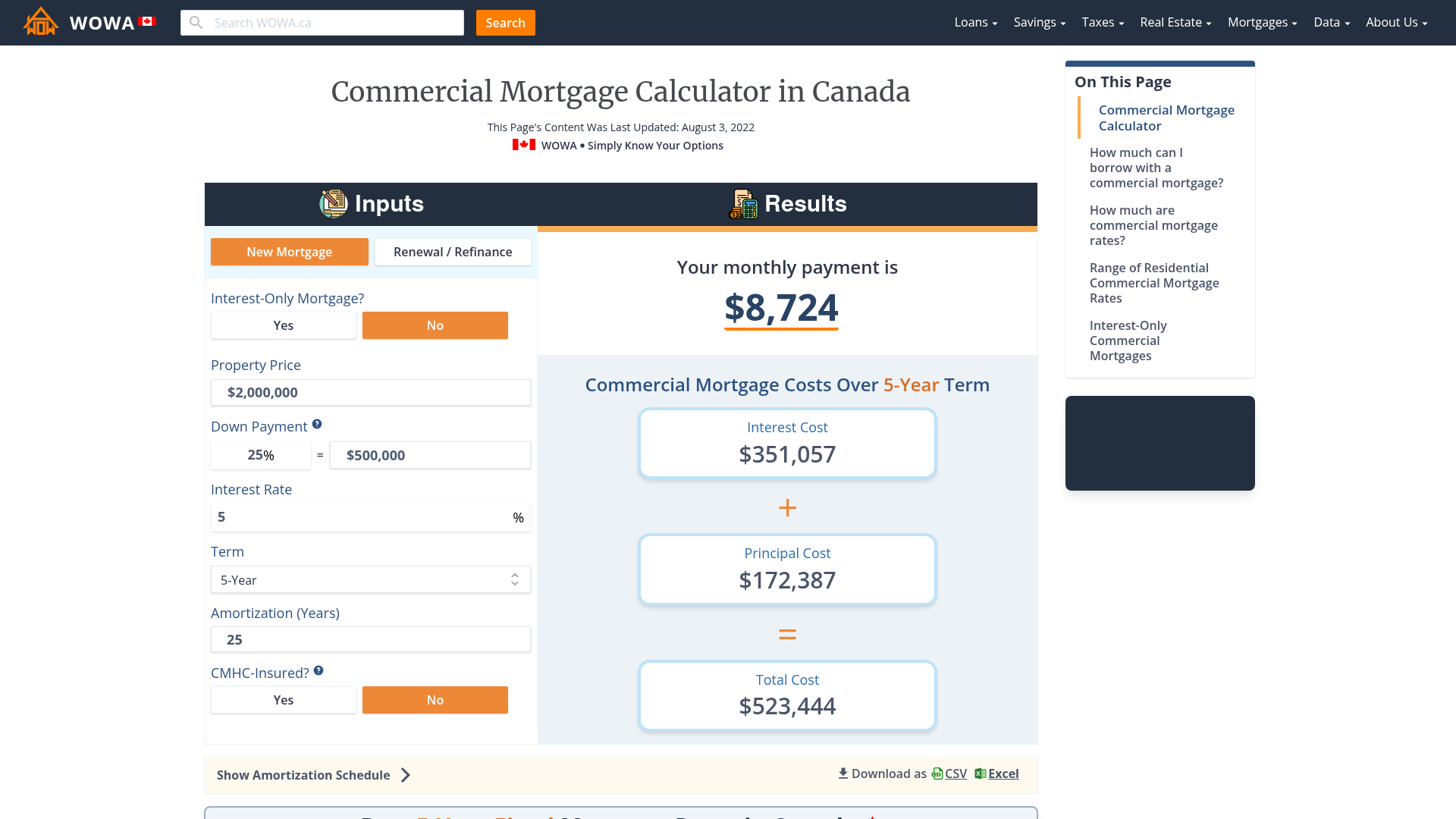

Your remaining loan balance. Our Closing Costs study assumed a 30-year fixed-rate mortgage with a 20 down payment on each countys median home value. This calculator will compute the payment amount for a commercial property giving payment amounts for P I Interest-Only and Balloon repayment methods -- along with a monthly amortization schedule.

Stamp duty concessions and exemptions are also available. Once we calculated the typical closing costs in each county we divided that figure by the countys median home value to find. The state tax is 50 cents per 100 of mortgage debt plus an additional special tax of 25 cents per 100 of mortgage debt.

NMLS Consumer Access LEAD GENERATOR ONLY NOT ACTING IN THE CAPACITY OF A MORTGAGE LOAN ORIGINATOR MORTGAGE BROKER MORTGAGE CORRESPONDENT LENDER OR. This calculator helps you work out the most you could borrow from the bank to buy your new home. The 36 part is that you shouldnt spend more than 36 of your income on monthly debt payments including your mortgage credit cards and other loans such as auto and student loans.

MoneyHero has a mortgage comparison tool which functions as a mortgage calculator. A commercial mortgage is a more complex concept. Calculate the cost of mortgage repayments.

Youll need to be age 55 or over. Manage your mortgage Mortgage fraud. A year to date calculator or YTD calculator is a tool used by lenders to work out your annual income from the income you earned in a part of a year.

You can use filter options at the top of the page to specify how much youd like to borrow and the loan tenor. Your income expenses and deposit are the biggest factors determining your borrowing power but lenders also consider other factors such as your existing debts and if you are using a guarantor for the loan. Battery life will be high when the load current is less and vice versa.

Calculate how much I can save ME N Item - 4 Col c Stamp duty. This is called your borrowing power. There are checks in the calculator to ensure that the inputs entered by you constitute a valid mortgage.

This is a loan that a business acquires in order to own property in an area zoned as commercial. There are a number of reasons why refinancing could be a great idea - the biggest being financial. Income If you calculate based on income the calculator will take information about your financial health and loan preferences combined with projected taxes and insurance to provide an estimate.

Calculate the additional repayment amount required to pay off your loan faster. CMHC mortgage loan insurance costs. Offered or referred to on this site are carried out solely by MHIBL in its capacity as an insurance broker.

Calculate my borrowing power ME N Item - 4 Col c Refinancing. A mortgage calculator can help borrowers estimate their monthly mortgage payments based on the purchase price down payment interest rate and other monthly homeowner expenses. To be eligible for a lifetime mortgage.

When you apply for credit lenders evaluate your DTI to help determine the risk associated with you taking. New York City Yonkers and several other cities also impose a local tax on mortgages in those jurisdictions. Identify how much you may be able to borrow for a mortgage.

In addition to your credit score your debt-to-income DTI ratio is an important part of your overall financial healthCalculating your DTI may help you determine how comfortable you are with your current debt and also decide whether applying for credit is the right choice for you. Our loan repayment calculator gives you an idea of what to expect should you decide to take out a loan. The lender will either use the YTD gross income figure from your most recent payslip the gross income stated in your last group certificate or the ATO Income Statement obtained from myGov website.

Chases mortgage affordability calculator creates an estimate of what you can afford and what your mortgage payments may be based on either. How much can I borrow. FAQs mortgage loan insurance.

CMHC home renovation financing options. First-time home buyer incentive. The calculation to find out the capacity of battery can be mathematically derived from the below formula When it comes to online calculation this battery life calculator can assist you to determine the time that how long the battery charge will last.

Todays Best Redmond Mortgage Rates. Use this YTD calculator to see how the banks calculate your annual year to date income when assessing your borrowing capacity for a mortgage or home loan.

Monthly Gross Income Calculator Freeandclear

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Mortgage Affordability Calculator 2022

Vacation Home Mortgage Calculator Vacation Property Online

Free Financial Calculators For Excel

Downloadable Free Mortgage Calculator Tool

Mortgage Calculators

Home Affordability Calculator For Excel

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Lvr Borrowing Capacity Calculator Interest Co Nz

Mortgage Payment Rate Calculators True North Mortgage

How To Calculate Your Debt To Income Ratio Lendingtree

Excel Formula Calculate Original Loan Amount Exceljet

Home Ownership Expense Calculator What Can You Afford

Downloadable Free Mortgage Calculator Tool

Bfiltqjc Ibeqm